Lump Sum vs. Dollar Cost Averaging

Controversiality: 5.5/10

Experts: 2/10 Public: 7/10 Delta: 0.7

Let's say you get access to a large sum of money and you want to put it into the stock market. Should you invest your money slowly over time? Or all at once?

Lump Sum (LS):

Investing a sum of money into the market all at once.

Dollar Cost Averaging (DCA):

Investing a sum of money into the market over time.

Periodic Investing (often called DCA as well)

Regularly investing a fixed amount of money at consistent intervals (e.g., monthly paycheck contributions). This is fundamentally different from holding a lump sum of cash and deliberately spacing out investments. There is still a difference between holding onto the cash paid by a paycheck and investing it immediately.

The Case for Dollar Cost Averaging:

Dollar cost averaging provides a good way to mitigate risk. Let's say you plan to distribute your investment over a period of 6 months and invest at the start of every month. The cost-basis of your investment would be the average value over those 6 months. Hence, the name "Dollar Cost Averaging."

The Problems with Dollar Cost Averaging:

The issue with DCA is the opportunity cost of the uninvested cash sitting idle. If the inflation rate is positive, that money is losing purchasing power. Additionally, if the general expectation is that the market will trend upward over time, not having the full amount invested from the start means missing out on potential gains.

The Case for Lump Sum:

If the market is expected to go up and inflation to be positive, a lump sum is best most of the time. This is because we are accumulating returns on all of our funds instead of just a portion.

The Problems with Lump Sum:

If an unexpected downturn occurs shortly after we make our investment, we will find that our cost basis is higher than if we had invested the money over a longer period of time.

The Verdict:

If an asset is expected to increase over time, investing earlier is generally better. If the asset is expected to decrease over time, you should be shorting it. Mathematically, it's better to lump sum an investment, but if you can't stomach a large drop, dollar cost averaging may help your nerves. However, you should know a lump sum will have higher expected returns.

Implications:

We don't need to assume the efficient market hypothesis for a lump sum investment to be the best strategy. Let's say we hold a portfolio of securities A and B, with 25% allocated to security A and the rest to B. Next, we find that a portfolio with 75% allocated to security A and the rest allocated to B has higher expected returns. The best play is to lump sum and convert our portfolio to a different allocation as soon as we figure this out. If we are operating on discovered information, it could be only a matter of time before others discover the same thing and our prediction becomes priced in.

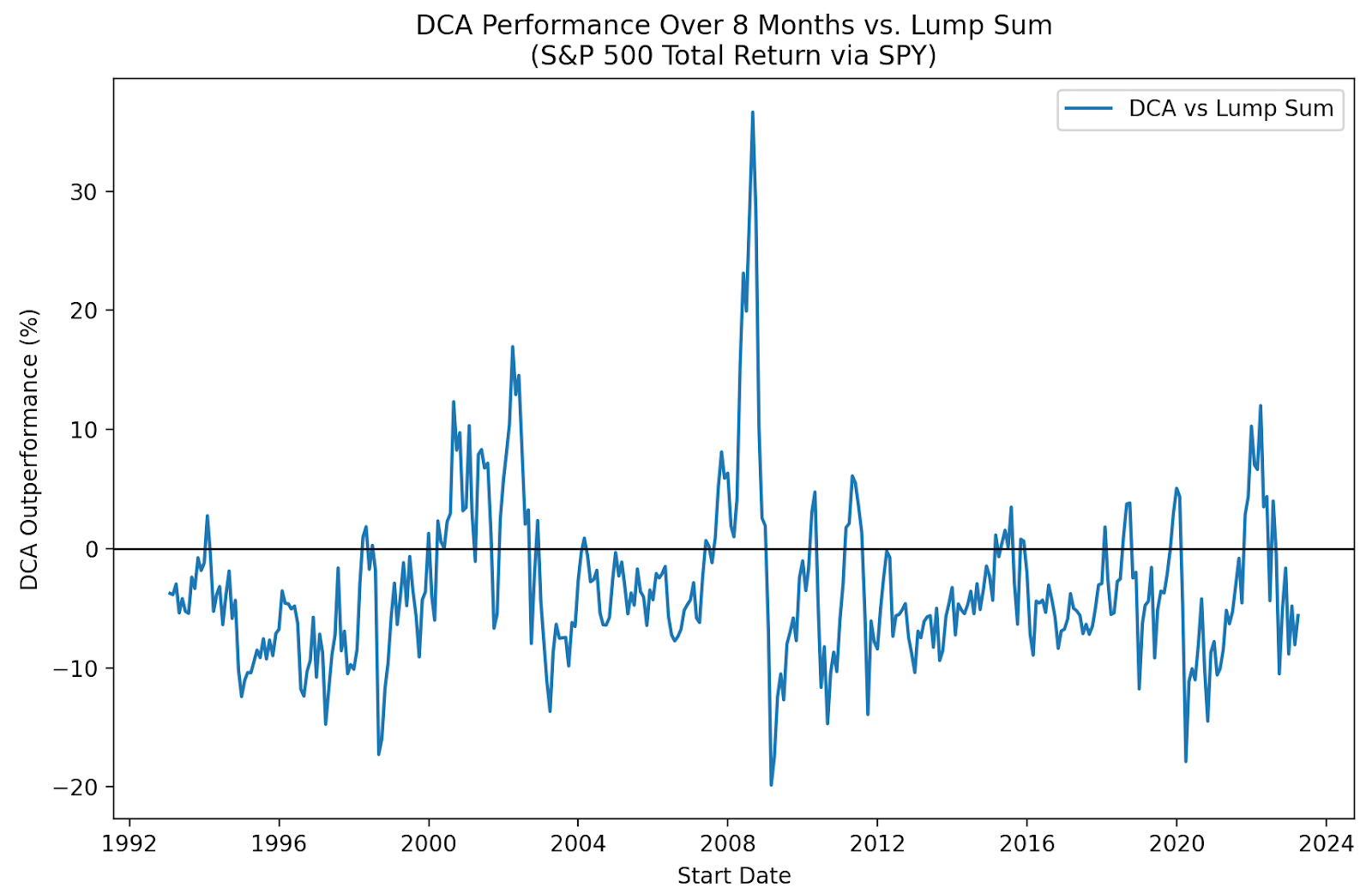

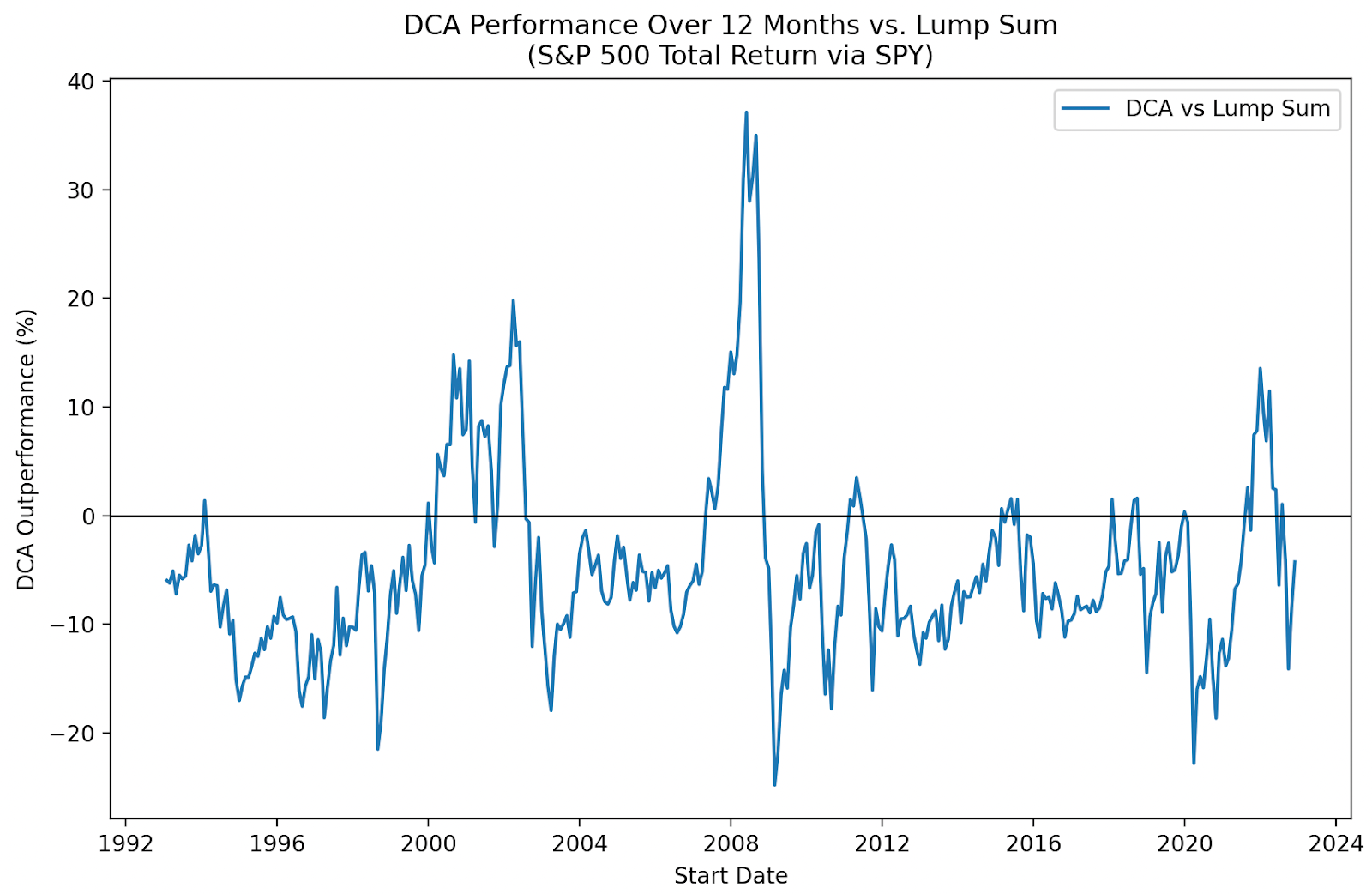

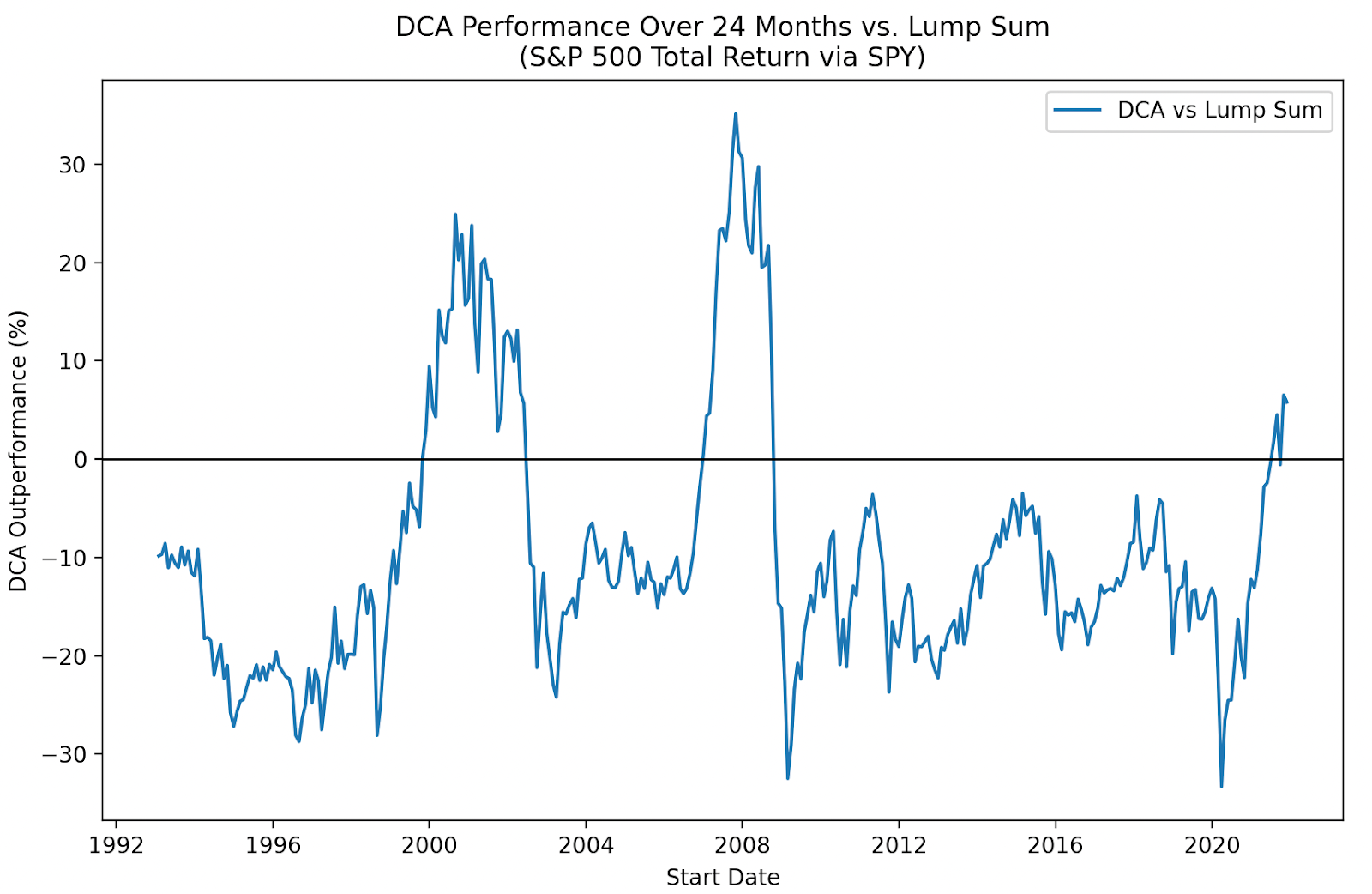

Data:

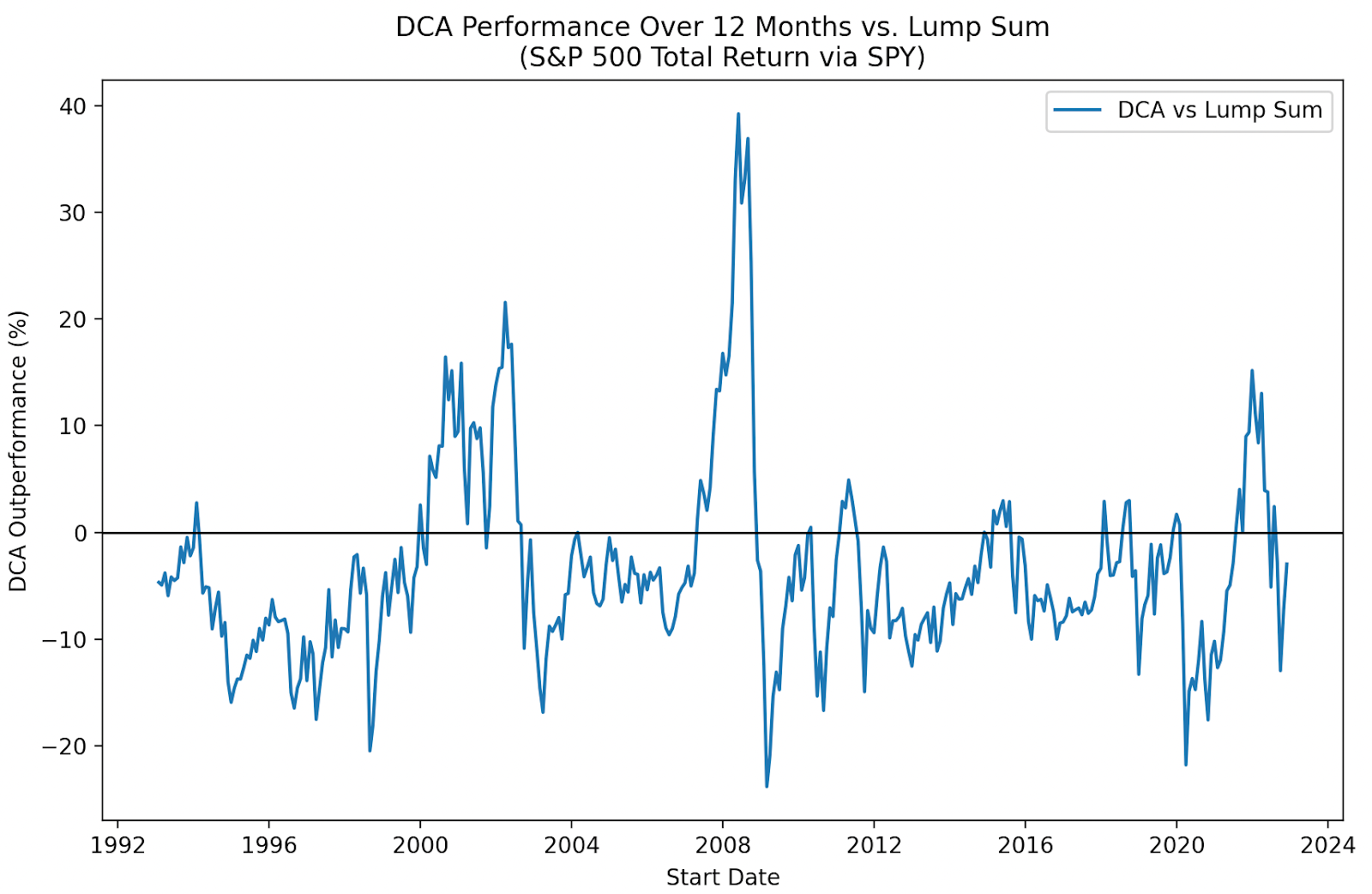

Here are some graphs that compare the performance of DCA and LS when investing in the S&P 500 from 1993-2024. I used ticker SPY from State Street which was created in 1993. LS outperforms during bull markets and DCA outperforms during bear markets which is pretty intuitive. The results become closer as we decrease the time period of DCA, since they end up becoming similar investments as the DCA time period becomes shorter. I don't recommend anyone solely invest in the S&P 500 alone. The reason I use it as an example is because it's the most commonly used market-cap weighted index. (Most likely due to its outperformance of other indices in recent history).

If you're concerned that the cash we let sit before investing should be invested at the risk free rate, here's a graph below for 12 months assuming that the risk-free rate is 3%.

I didn't put a dynamic risk free rate depending on time since I was lazy but also because it would start to erode the value of what we're observing. We're trying to figure out if DCA vs LS is better generally, the answer is it depends if we expect the asset to appreciate long term, LS will increase our expected returns. DCA may provide the investor with some more piece of mind, but just know the longer you're not invested, the higher the opportunity cost. Money is valuable. Banks literally pay you to keep your money with them. Take advantage of it.

Related Articles and Resources:

Article on Bogleheads wiki defining DCA and comparing it with LS. I really like the way they explain LS vs DCA here: Boggleheads Wiki

Article showing results of study done by Vanguard on LS vs DCA with MSCI world index: Vanguard Article