Is Investing in Unethical Companies Unethical?

Controversiality: 9.38/10

Experts: 7.7/10 Public: 9.8/10 Delta: 0.8

Why is investigating ethicality important?

An investor’s decisions may be impacted by their moral compass. If it has an effect, how does it affect their returns? What’s the difference between passive and active investors in this context? If you are a passive investor that only invests in the market, should you be worried about the ethical implications of your investment? What strategies are there to make sure you have a positive impact on the world as an investor?

Defining Ethicality

Every investor’s moral compass is different. To the vast majority of investors there are common traits companies may have to be labeled as “unethical.” They could be polluting the environment, exploiting workers, falsely advertising, causing harm to its consumers, etc. These aren’t canonical since people have different moral compasses. For example, it’s possible an investor’s religious text claims that polluting the environment is a good thing, which means they’ll have the opposite moral views to most people.

For these reasons, we won’t be discussing exactly which companies are ethical/unethical because it’s completely subjective. An intelligent investor worried about the impact of their investments should label companies themselves by doing research and referring to their own moral compass.

How about we just invest only in ethical companies and avoid the others?

This approach may seem straightforward at a first glance, however, there are many issues that come with just avoiding unethical companies. An intelligent investor may leave a company out of their investments if they think it’s unethical. However, they may have not thought about what that action means. Not buying a specific company's stock is a relative short position on that company compared to the global market. This pushes that company’s stock price down and other companies up. By wanting to stay out of affecting that company’s stock price, we may unintentionally be affecting the price even more. If the investor’s intention was to completely avoid the company and have no effect on the stock price, they have failed.

Trying to avoid certain companies is possible but adds a lot of complexity. It would be very difficult for a passive, retail investor to accomplish efficiently avoiding investing in an arbitrary set of companies, especially, if they vary greatly from investor to investor. We can’t really just make an “ethical” ETF for everyone to use because our definition of ethically changes which means the set of unethical companies changes. Passive investment strategies like investing in an index fund would be challenging because we would either have to manage short positions, (which would be challenging for retail investors) or avoid index funds entirely.

What is the ethical impact of investing in a certain stock?

If we equate our impact on stock prices to morality, then we just have to make sure our moral impact is at least neutral. Let’s identify an unethical company. If we can show our investment has no impact on the price of a stock, then we can argue it has no negative effects, and therefore, our investment is ethical even if the company is unethical. It’s natural to think that larger investments have a bigger impact than smaller ones. So it would follow that richer investors have more ethical responsibility than poorer ones. Is this impact proportional to the investment?

Do our investments actually have an impact on stock prices?

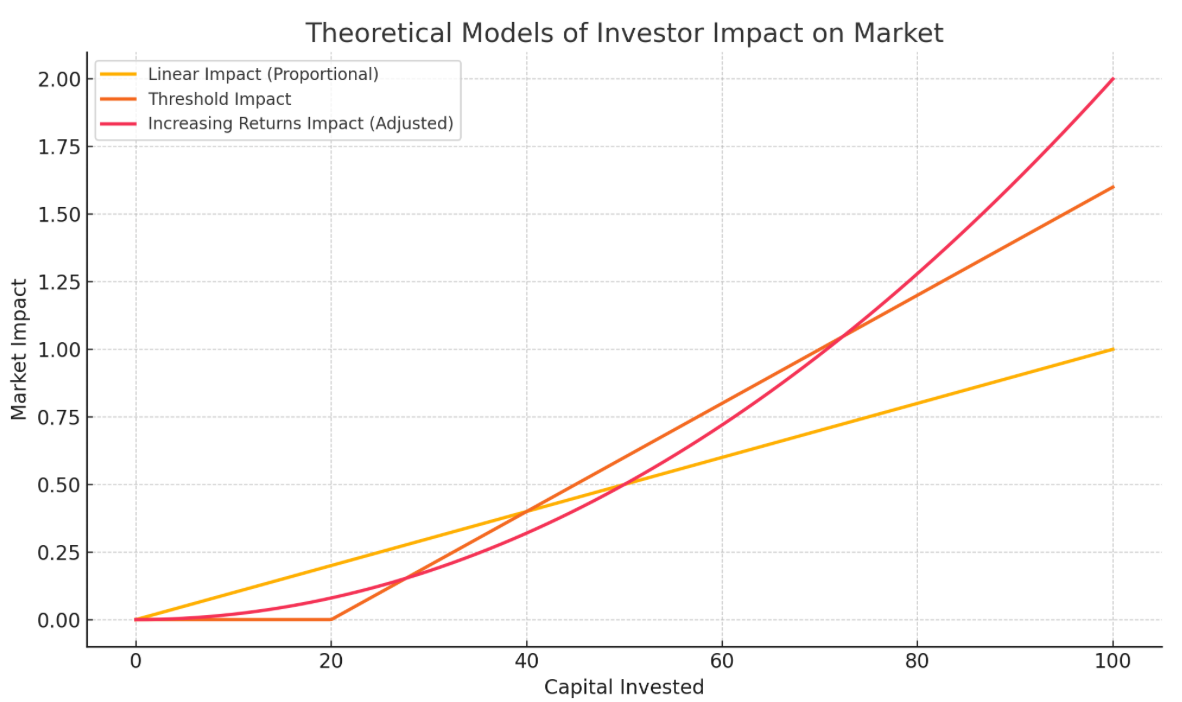

Doesn’t ethically not really matter if our investments don’t actually influence stock prices? Theoretically, an investor with vast amounts of capital should have a higher impact on stock prices than a small investor. The question is, is this difference proportional? Would a very small investor actually have 0 impact on the market or is it just very small? Maybe there's a threshold to where we need enough capital to make stock prices move?

It’s probably a lot more complicated than this because many factors could change the curve such as the specific investment and timing. I’m gonna leave this as an open question.

An interesting conclusion about retail investors with no advantage

There’s a point about efficient markets that I want to make. In general, a retail investor with no advantage should assume the strong-form efficient market hypothesis. The hypothesis claims that an investor cannot make returns higher than the market adjusted for risk. Let’s say there’s a sum of money that we want to invest into the market. We can label some set of companies as unethical and our investment may have some immoral impact due to investing in these companies. Let's say we’re retail investors with no advantage but we still deviate from the market and decide to go long on company A compared to the market. Since we’re assuming EMH, the market should have perfect knowledge about company A’s future profits. Since A’s stock needs to be priced efficiently, we can assume another investor with better knowledge than us would go relatively short on that position (equal to our long position) and that company’s stock price would end up being the same. I personally would argue here that we made no immoral impact if the company was unethical since we have only transferred ownership of the company but haven’t made any functional impact. But this assumes that we haven’t generated any alpha on making this play. An investor would only deviate from the market if they think they can generate alpha (or maybe they just don’t know they deviate). I think it’s important to find out if a retail investor with limited capital and no advantage has a different ethical impact from deviating from the market. I think the answer is that an investor with no advantage actually has an equal impact to all other investors with no advantage because they don’t influence the price of stocks. This leads us to an interesting conclusion: An investor with no advantage has a constant moral impact in the stock market with respect to their position. The only variable that would change their impact is the size of the position.

This seems like it works to me for investors without an advantage but I’m not sure if it holds true for investors with an advantage. This is because there shouldn’t be other investors to take the opposite position of an investor with an advantage because that would get rid of their advantage. I think the size of their impact changes with respect to their alpha, since it was their alpha that disallowed us to come to a conclusion. So it’s possible investors with an advantage have a variable moral impact in the stock market with respect to their position. I think it’s possible that it’s the alpha that they generate that changes their moral impact and not the specific investments whether the companies are moral or immoral. So if we hold their alpha constant, then even investors with an advantage have a constant moral impact in the stock market with respect to their position. I’m much less confident about this conclusion compared to the one with investors without an advantage. Maybe every investor has the same moral impact with only the size of the position as a factor to change it. I don’t know. It’s important to note that investors that generate alpha do provide value in the form of efficiency. Efficient pricing helps people evaluate investments, companies evaluate their decisions, and even politicians evaluate their policies.

The conclusions we can come up with are pretty funny. If we assume EMH and we make up a company called Evil Inc. that regularly pollutes, exploits its workers, and falsely advertising its products as safe but in reality are harmful, addictive drugs, then investing in that company alone has the same moral impact as investing in the S&P 500.

Okay enough about this.. Let’s examine some other points.

All companies aren’t the same

Investment impacts differ significantly among companies. Investing in a large corporation that already holds huge cash reserves has little impact. In contrast, the same investment in a small startup that’s strapped for cash is a different story. Smaller companies, especially startups, often depend heavily on initial funding to launch or sustain operations, making investments particularly impactful. I think it’s important here to note that an equal-sized investment would not proportionally affect large and small companies. Companies with extensive cash reserves gain little practical benefit from additional public stock investments, meaning such investments do not substantially aid the company’s growth or operations. Some companies have so much cash on hand they decide to buy back their shares to reward investors.

Let’s take large tech companies for example. They have seemingly limitless cash reserves allowing them to outright buy other companies. These highly profitable companies may even buy back their shares with their cash. In this case, giving the company cash in exchange for ownership shouldn’t change the outlook of the company since more cash isn’t really that useful for them. This contrasts with a company that is in debt and needs some cash to get their operations running. In this case, investing the same amount of money in an unethical startup has much more moral impact than the large corporation.

What’s the cost of avoiding investing in the stock market all together?

Does keeping our money sitting in a bank have unintended consequences other than the obvious? (lower returns). Even if investing in some companies can be seen as unethical, investing in the stock market can still be seen as morally good as it stimulates the economy by allowing companies to invest in more projects. Investing creates jobs and facilitates the advancement of society. It can be argued that some of the moral consequences can be counteracted by these effects. There’s also other consequences of keeping our money in the bank. That’s because money sitting in there is being invested by the bank to make money from themselves. So maybe you should invest your money yourself so you can make decisions on what it should do rather than a bank.

Can we invest in charity to offset harm done?

If investing in a company does lead to negative consequences, it could be counteracted by donating to a charity that helps the opposite cause. One could argue that you can still invest in unethical companies if the difference in profits(compared to ethical only) coming from unethical sources is redirected to stop those practices. It could even be argued that investing in unethical companies is MORE ethical than not doing so if you donate a sufficient amount of the profits to charities that reverse the effects of the unethical practices. From a utilitarian perspective this makes sense, but it still may mean doing something unethical even if the sum of the actions does turn out to be positive. A deontological perspective may argue that you should strictly avoid unethical industries. Here, it depends on your views whether giving to charity can reverse some immoral actions.

Investors do have some control

It could be true that for an unethical company, if the stock price increases, it tells the company unethical actions should be rewarded, which encourages the company to continue their unethical behavior. Something people don’t usually think about is that investing does grant you a certain amount of power within the company which you can use for good.

People with high stakes in companies hold more power over that company and can make decisions. Having a stake in the company and voting against unethical practices can have a positive impact to make the company more ethical.

In addition, anyone investing in an index fund and are upset about companies they’re investing in being unethical, should participate in voting. Buying shares in unethical companies and voting against unethical practices should be completely ethical since you are enacting positive change and discouraging unethical practices. In this way, you have more power to help society compared to someone who didn’t invest in the company at all. You can even make the argument that owning more shares of unethical companies can be ethical as long as you exercise your power as a shareholder. Most people who hold index funds don’t participate in voting or attend shareholder meetings. But you should!

Gambling

Many religions and ideologies avoid gambling. But is investing in the stock market gambling? What’s interesting is that I think it’s actually subjective. Many religions agree that investing is okay but gambling isn’t. What the problem is though is that most investors who deviate from the market invest with the intention that they know more than the market. If you make risky option plays but you have a legitimate reason for doing so and genuinely believe you have an advantage, then it’s investing, and not gambling even if in reality, you don't have an advantage. So I guess the important thing here is for you to BELIEVE that your decision is a smart one for it to not be gambling.

What are my options if I want to exclude some companies from my index fund?

The most efficient way to do this would be to do direct indexing which would mean buying every company in the index. This isn’t really feasible for most investors however. Investing in bear etfs could work in some cases however most of the time, these instruments only capture daily returns so a 1x bear ETF wouldn’t have a high correlation with the stock long-term. The only other real option I can think of is to invest in “ethical etfs” but those are pre-labelled (which may have different labeling than you) and most probably higher fees than normal funds.

Can we shift the blame off of investors and onto someone else?

A great way to argue that investors don’t bear ethical responsibility is to shift the blame onto someone else.

Does the blame fall on the consumers?

It could be argued that consumers are partially to blame for an unethical business to exist. A person that knowingly chooses to purchase products from an unethical business directly supports it as long as the company profits off of it. It’s important for consumers to know how their products are being sourced, however, it’s not completely their responsibility to know everything. A consumer is more likely to buy a product that was ethically obtained than one that was unethically obtained as long as the price of the ethically obtained product isn’t much higher. This threshold depends on the consumer, but this choice is only made possible if the consumer has the knowledge of how ethically obtained their goods are. It’s reasonable to expect consumers to be mostly informed about good and bad things happening around the world but it’s unreasonable to expect they know everything about each product they buy. I think consumers bear responsibility in the case where they knowingly buy a product from a company they deem unethical just to save some money.

Does the blame fall on the company executives?

The company executives that resort to unethical practices to make more money could also be considered to have blame. If their practices involve gray areas or possible unethical practices, they should be open about these to their consumers so their consumers can decide if it’s worth the savings. It’s also important to be open about their practices to the government since they need to oversee and regulate if they find any practices to be unethical. An executive that purposefully hides their unethical practices to the government and the public is unethical. However, as long as their practices are legal and they are open about them, there shouldn’t be much of an issue.

Does the blame fall on the government?

One of the responsibilities of the government is to decide what is and is not ethical and create laws to enforce them. This means there’s no room for ethicality in society if the government operates perfectly. However, it’s impossible to achieve this since people in a society have different moral compasses and so making laws to enforce unethical behavior would contradict each other. That being said, most unethical practices are seen as unethical by the vast majority. For example: pollution, promoting harmful activities, false advertising etc. If there’s evidence a company is operating unethically, the government should investigate this and create laws to prevent them. They also need to enforce them properly so people follow them.

So let's summarize why it’s ethical to invest in unethical stocks

You can shift the blame.

You can use your voting rights.

You can donate to offset the harm.

You can claim investing doesn’t actually help the company.

You are stimulating the economy by helping create jobs and advance society.

You are contributing to price discovery.

Now let's summarize why it's unethical to invest in unethical stocks

You’ll root for companies with unethical practices.

You may help or encourage a company to continue with unethical practices.

You profit off of unethical behavior.

Comparing Ease of Investing/ Profitability of different Relgions/Worldviews

I’ve created a list of different religions/worldviews ordered by their ease of investing/ profitability. Since different worldviews have different ethical thinking, some pose more restrictions than others. More restrictions generally lead to less profits. You shouldn’t pick your religion based on what you can invest in, but if you really want to, here’s what I think.

1. Nihilism

Very High Ease & Profitability: Nihilism having no inherent moral restrictions as well as having the belief that morality is completely subjective earns it the top spot. There are certain nihilists for example, existential nihilists who believe they can give life their own meaning which may pose restrictions.

2. Atheism

High Ease & Profitability: Atheism is the general lack of belief in any god. There aren’t really any absolute restrictions when it comes to investing in stocks.

3. Existentialism

Moderately High Ease & Profitability: The belief that creating meaning is the responsibility of the person gives more power to the investor. What it does mean is that it really depends on how the person defines and chooses to live their own life.

4. Agnosticism

Moderately High Ease & Profitability: This one’s pretty interesting. The belief in not knowing if god exists is hard to interpret in the context of investing in stocks. They value reason and critical thinking and do not completely reject religion. I think putting agnosticism above most popular religions but below more free-thinking worldviews makes sense.

5. Judaism

Moderately High Ease & Profitability: From what I’ve found, Judaism seems to be the most flexible in investing out of most religions. They emphasize social responsibility and shareholder engagement and don’t have too many restrictions.

6. Christianity

Moderately High Ease & Profitability: I think Christianity depends a lot on the denominations but they all stress to be ethically responsible when managing assets. Using donations or shareholder advocacy to offset investing in harmful companies seems to be more accepted when compared to other popular religions, but may still be debatable.

7. Secular Humanism

Moderate to High Ease & Profitability: This worldview advocates for socially responsible investing, and it may allow some flexibility within clear ethical boundaries.

8. Sikhism

Moderate Ease & Profitability: From here on, the religions appear to be more restrictive. Sikhism emphasizes ethical purity, but it doesn’t seem to have much flexibility in terms of advocating for better decisions within companies and it overall allows for moderate investment opportunities.

9. Hinduism

Moderate-Low Ease & Profitability: Hinduism has more clear ethical guidelines that limit investing in harmful sectors. Donating to charity to offset immoral behavior is discouraged, but advocating for better practices is still encouraged.

10. Buddhism

Low Ease & Profitability: Buddhism seems to more heavily restrict investment options, strongly advocating against harm.

11. Islam

Very Low Ease & Profitability: Islam imposes pretty heavy restrictions on what you can invest in. Harmful sectors like gambling, weapons, alcohol, seem to be completely restricted even with workarounds discussed earlier. They also prohibit investing in interest-bearing instruments which seems to be unique. I’m curious if investing in an index fund that covers the market and then shorting unethical companies would be accepted if the total investment is the ethical companies minus the unethical ones, since you’re still investing in the ethical ones.